Saturday AM Economist: Mortgage Update, Mixed-Use Homes, and more!

Welcome to this edition of my Saturday Morning Economist, where I'm sharing the latest mortgage market updates, along with additional information and insights that I believe you may find helpful.

Mortgage Market

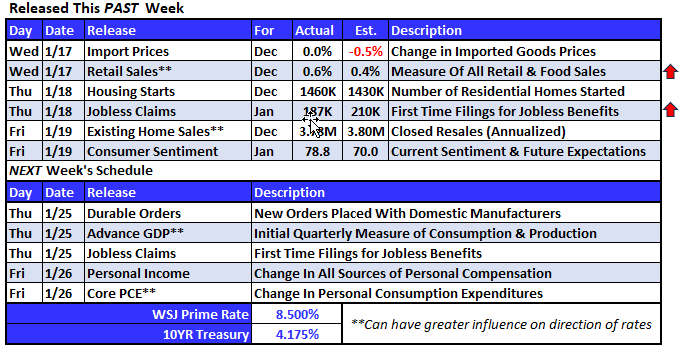

This week, positive housing supply news came via New Home starts which were 16% higher than a year ago. Retail Sales data for December on consumer spending was stronger than forecasted while labor data on Jobless Claims was less than expected. Both the spending and labor reports indicate economic growth, causing upward pressure on rates which ended the week slightly higher.

Next week I'll be closely monitoring GDP readings to be released Thursday and inflation readings (PCE) to be released Friday for any potential impact on home financing terms.

Did You Know?

Topic: Mixed-Use Properties

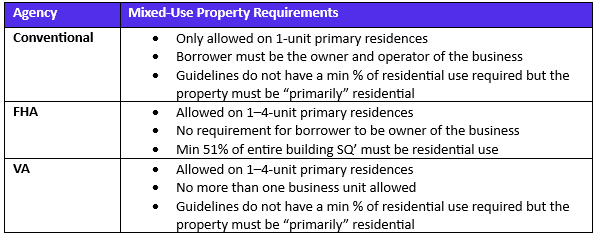

Did You Know that all agencies allow Mixed-Use Properties given that the property is primarily residential in nature and not modified in a manner that has an adverse impact on its marketability as a residential property? Mixed-use refers to a residential property with a business use. This can include, but is not limited to, properties with space set aside for day care, a beauty salon, or a doctor's office.

Each agency has specific requirements for mixed-use properties which can differ between them. Where one agency may not allow a property, another may. We, as lenders, are heavily dependent on the appraisal report to determine the eligibility of the property.

Please reach out to me when there is a property that you are unsure of its eligibility. Although the final determination will come down to the appraisal report, I'm always happy to review online listings, county records, and/or other property information to give guidance.

Economic Data Points:

If you have any questions, please let me know, I'm always happy to help both you and your clients.

Karyn McAlpin VP, Sr. Loan Officer, NMLS ID #505392 M: (704) 754-0192 Email Me View My Website

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower 01/2024 | This e-mail message and any attachments may contain trade secrets or proprietary, confidential, or privileged information about or relating to Atlantic Coast Mortgage, LLC (ACM). If you are not the intended recipient of this email, then you are prohibited from using, distributing, forwarding, or reproducing it. If you have received this email in error, please immediately notify ACM and delete this e-mail, and any attachments, from your computer system. Certain views and opinions expressed in this email, and any attachments, may be personal to the sender and not necessarily reflective of the views of ACM. Atlantic Coast Mortgage, LLC is an Equal Housing Lender | 4097 Monument Corner Drive, Suite 600, Fairfax, VA 22030 | Company NMLS ID 643114 (www.nmlsconsumeraccess.org).

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "